Table of Contents

Toggle🚀 Introduction: Feeling Crushed by High EMIs? You’re Not Alone

You finally bought your dream home—the one with the cozy balcony and perfect view.

But every month, the hefty home loan EMI hits your account like clockwork, leaving you wondering:

❓ “Can I reduce this EMI somehow?”

The good news? Yes, you can!

With the right strategies, you can cut down your monthly burden, reduce your loan tenure, and save thousands in interest.

In this guide, you’ll learn:

✅ 10 practical ways to reduce your EMI.

✅ How to negotiate better interest rates.

✅ Smart tips to prepay and save on interest.

By the end, you’ll know exactly how to optimize your home loan—and free up more cash for yourself. 💡

💰 1. Opt for a Longer Loan Tenure

Want lower EMIs instantly?

Increase your loan tenure.

✅ When you extend your loan duration, your EMIs become smaller, making them easier to manage.

✅ However, you’ll end up paying more interest over time.

🔎 Example:

Let’s say you have a ₹50 lakh home loan at 8% interest:

- Tenure: 15 years → EMI = ₹47,782

- Tenure: 25 years → EMI = ₹38,591

💡 Impact:

By extending the loan tenure by 10 years, your EMI drops by ₹9,191.

But you’ll pay more in total interest.

✅ Pro Tip:

- If you’re struggling with monthly expenses, longer tenure helps ease the EMI burden.

Later, when you have extra cash, make prepayments to reduce the overall interest.

| Loan Amount | Interest Rate | Tenure | EMI |

|---|---|---|---|

| ₹40L | 8% | 20 years | ₹33,458 |

| ₹40L | 7.5% | 20 years | ₹32,000 |

🔥 2. Negotiate for a Lower Interest Rate

Why pay more when you can pay less?

Lenders often offer reduced rates to loyal or low-risk borrowers.

🔎 How to Negotiate:

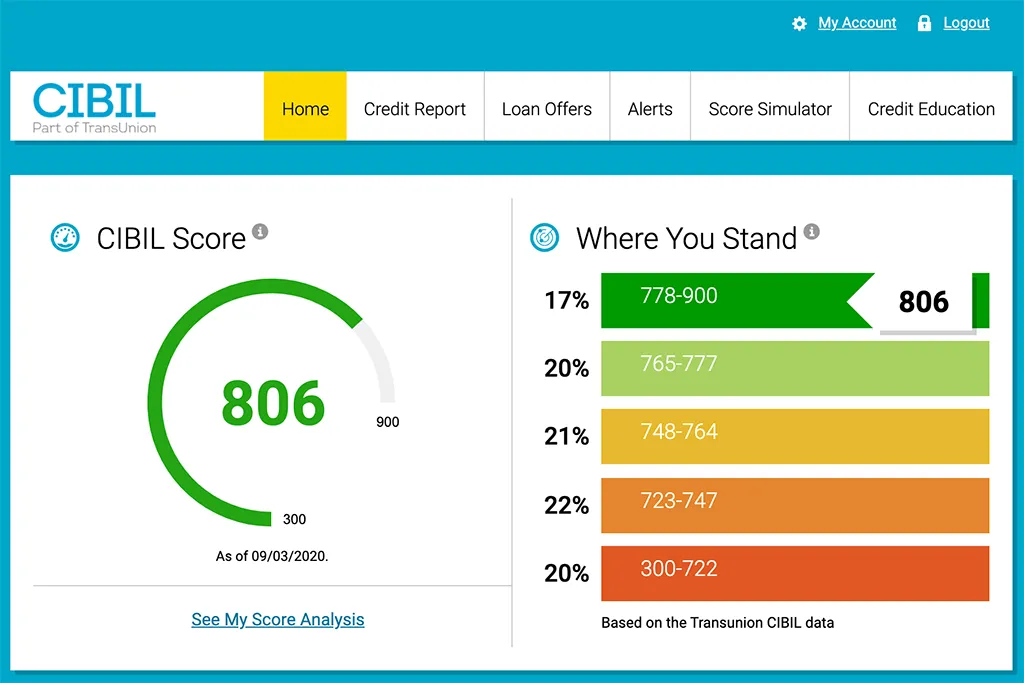

✅ Check your credit score:

- A 750+ CIBIL score gives you more negotiation power.

- If your score is low, improve it before negotiating.

✅ Compare other offers:

- Research other banks or NBFCs offering lower rates.

- Use this as leverage to get your lender to reduce your rate.

✅ Request rate adjustments:

- If RBI cuts repo rates, ask your lender to reduce your floating rate.

- This directly lowers your EMI.

✅ Pro Tip:

Even a 0.5% interest reduction can save you lakhs over the loan tenure.

If your current rate is high, switch to a lender with better offers.

“Consider top lenders if switching to a lower interest home loan.”

💡 3. Refinance or Transfer Your Loan to a Lower Rate

Stuck with a high-interest home loan?

Switch to a lender offering better rates through a home loan balance transfer.

🔎 How It Works:

✅ You transfer your existing loan to a different bank with a lower rate.

✅ Your EMI reduces due to the lower interest.

✅ You continue paying the new EMI at the lower rate.

🔥 Example:

You have a ₹40 lakh home loan at 9% interest:

- EMI = ₹35,000/month

- If you transfer to 7.5%, your EMI drops to ₹32,000.

💡 Savings:

You save ₹3,000 monthly → ₹36,000 annually → ₹7.2 lakh over 20 years. 💰

✅ Pro Tip:

- Check processing fees before refinancing—ensure the savings outweigh the charges.

Opt for lenders with no hidden fees.

“Calculate your EMI after refinancing or tenure extension.”

🔥 4. Make Prepayments Whenever Possible

Got a bonus or unexpected cash?

Use it to prepay your loan.

✅ Prepayments directly reduce your principal.

✅ Lower principal → less interest → lower EMI.

🔎 Example:

Loan Amount: ₹50 lakh at 8.5% interest for 20 years.

- EMI: ₹43,391

- You prepay ₹5 lakh after 3 years.

- Your EMI reduces to ₹39,952.

💡 Impact:

You save ₹3,439 monthly → ₹41,268 annually → ₹8.25 lakh over 20 years.

✅ Pro Tip:

- Prepay early in the loan tenure to save more on interest.

Even small prepayments make a big difference over time.

“Reduce overall EMIs through consolidation strategies.”

🏦 EMI Calculator

Your EMI: ₹0

5. Increase Your EMI Amount Gradually

5. Increase Your EMI Amount Gradually

Got a salary hike?

Instead of spending it, increase your EMI.

Example:

Example:

Loan Amount: ₹40 lakh at 8% interest for 20 years.

- EMI: ₹33,458

- You increase the EMI by 10% annually.

You repay the loan in 12 years instead of 20 → saving ₹11 lakh in interest.

Pro Tip:

Pro Tip:

- Use the extra cash from bonuses or appraisals to increase your EMI.

This helps you pay off the loan faster without burdening yourself.

“Use cashback to help reduce monthly EMI burden.”

🔥 6. Choose a Floating Interest Rate

If you’re on a fixed-rate loan, consider switching to a floating interest rate.

✅ Floating rates are lower during periods of falling interest rates.

✅ Lower interest → lower EMI.

🔎 Example:

Fixed Rate: 9% → EMI = ₹45,000

Floating Rate: 7.5% → EMI = ₹41,000

💡 Impact:

You save ₹4,000 monthly → ₹48,000 annually.

✅ Pro Tip:

- Floating rates are riskier but often cheaper in the long run.

Use them if interest rates are projected to drop.

💡 7. Switch to MCLR or RLLR-Linked Loans

If your loan is linked to the Base Rate or PLR, switch to:

✅ MCLR (Marginal Cost of Funds-Based Lending Rate).

✅ RLLR (Repo Linked Lending Rate).

These loans reflect RBI rate cuts faster, giving you:

✅ Lower EMIs.

✅ Faster savings on interest.

🔎 Example:

Old Rate: 9.5% (PLR) → EMI = ₹50,000

New Rate: 7.8% (RLLR) → EMI = ₹44,500

💡 Savings:

You save ₹5,500/month → ₹66,000 annually → ₹13.2 lakh over 20 years.

✅ Pro Tip:

- RLLR loans adjust quickly with RBI rate changes.

If rates are falling, switch to RLLR-linked loans.

Home Loan Eligibility Calculator

🔥 8. Maximize Tax Benefits

Use tax benefits to save money and lower your effective EMI.

✅ Section 80C: Deduct up to ₹1.5 lakh on principal repayment.

✅ Section 24(b): Claim up to ₹2 lakh on interest paid annually.

✅ Pro Tip:

- File your returns correctly to maximize deductions.

Use the savings to prepay your loan.

🔥 Conclusion: Lower Your EMI, Increase Your Savings

Reducing your home loan EMI isn’t just about paying less—it’s about smart financial planning.

✅ Increase tenure or refinance for immediate relief.

✅ Prepay and increase EMI for long-term savings.

✅ Leverage tax benefits to reduce your overall burden.

💡 Next Step:

👉 Apply these strategies today → Enjoy lower EMIs and save lakhs over your loan tenure! 🚀

🎁 Free Bonus: Download Our “Checklist to Reduce Your Home Loan EMI in 2025 (PDF)”

👉 Get a step-by-step guide on how to reduce your loan burden. Download Now

In 2025, the most effective way to reduce EMI is to refinance your home loan to a lower interest rate and make part-prepayments early in the tenure.

Yes, you can negotiate with your current lender for a rate reduction or increase your loan tenure to reduce EMI without changing lenders.

Both are effective, but increasing your EMI regularly reduces tenure and interest faster than occasional prepayments.

A home loan balance transfer involves transferring your existing loan to another lender offering a lower interest rate, potentially reducing your EMI.

Utilizing your annual bonus to make a lump sum payment towards your loan principal can significantly reduce your EMI and overall interest burden.

A mortgage recast involves making a lump sum payment towards your loan principal, leading to a recalculation of your monthly payments based on the new balance.

Increasing loan tenure can reduce your EMI by spreading the repayment over a longer period, but it may result in higher total interest paid.

Yes, many lenders offer the option to switch from a fixed to a floating interest rate, which can lower your EMI if market rates decrease.

Example:

Example: