Table of Contents

Toggle💡 Introduction: Why Your CIBIL Score Matters More Than You Think

Let’s be real—there’s nothing scarier than applying for a loan and seeing that disheartening message:

“Application rejected due to low CIBIL score.” 😱

Think about it. Whether you’re buying your dream home, applying for a car loan, or simply trying to get a better credit card, your CIBIL score holds the keys to the financial kingdom.

But here’s the good news:

You don’t have to wait years to fix your score. With smart financial moves, you can improve your CIBIL score fast and boost your chances of securing loans at lower interest rates. 💡

In this guide, I’ll share practical, real-world tips (no boring jargon) to help you skyrocket your CIBIL score—faster than you think. 🚀

🚀 What is a CIBIL Score and Why Does It Matter?

✅ H2: CIBIL Score Explained in Simple Terms

Your CIBIL score is a three-digit number (300 to 900) that reflects your creditworthiness.

- A score above 750 → Excellent → Banks love you. 🤑

- A score between 650-750 → Good → You’ll likely get loans but not at the best rates.

- A score below 650 → Poor → You’ll face loan rejections and high-interest rates.

💡 Why It Matters:

- Loan approvals: Higher scores mean faster approvals and better deals.

- Lower interest rates: A high score gives you negotiating power.

Credit card benefits: Premium cards with better rewards become accessible.

📰 As per RBI’s latest 2024 guidelines, all lenders are now required to update borrower repayment history within 7 days—making it easier to see faster score improvements.

🔥 10 Expert Tips to Improve Your CIBIL Score Fast

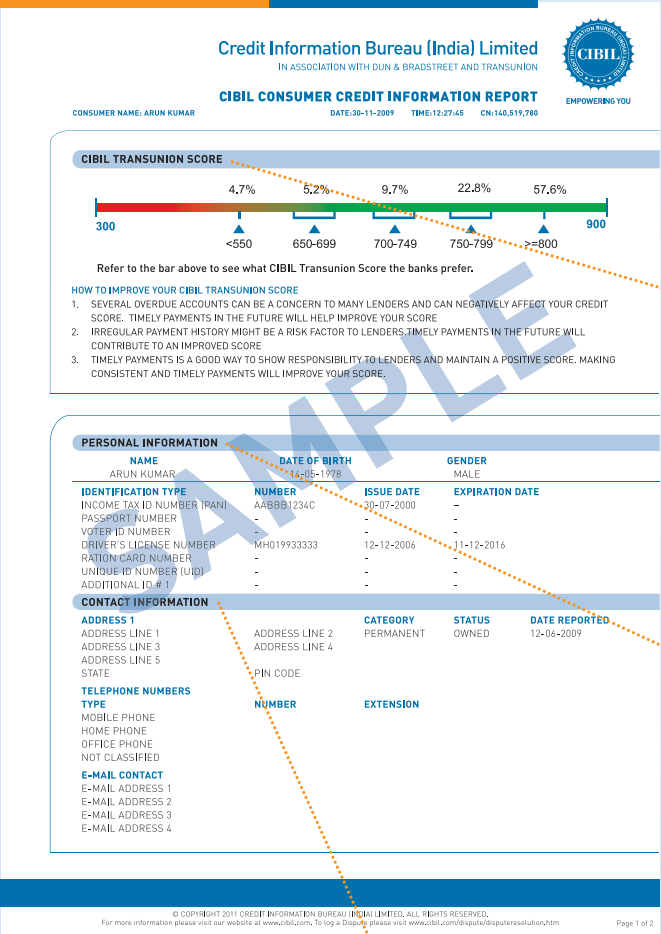

🛑 1. Check Your Credit Report for Errors

Let’s be honest—credit bureaus aren’t perfect.

Even a minor error, like a wrong payment date or a loan you never took, can drag down your score.

💡 Action Plan:

- 👉 Get a free CIBIL report once a year from CIBIL.

- 🔍 Check for errors like inaccurate payment history or duplicate accounts.

- ✉️ If you spot a mistake, dispute it immediately.

📊 Fun Fact:

According to a Reserve Bank of India (RBI) report, 22% of CIBIL reports contain errors that affect scores.

“A high CIBIL score unlocks access to better personal loans.”

🧠 Quick Quiz: How Healthy is Your Credit Profile?

Take our 2-minute quiz to get a free credit health score and actionable tips!

👉 [Start the Quiz]

🧠 Check Your Credit Health

Fill out the quiz to get tips on improving your credit profile.

👉 Learn more from RBI’s official page on credit information.

👉 Check your CIBIL score directly on the CIBIL official site.

💳 2. Pay Your Credit Card Bills on Time (Even the Minimum Due)

Think about it—missing payments by even a day can leave a dent in your score.

Late payments show up on your report and signal financial irresponsibility.

💡 Quick Fix:

- Set up auto-pay to avoid missing deadlines.

- Always pay at least the minimum due—though paying in full is best.

Pro Tip: Even if you’re short on cash, paying the minimum keeps your account in good standing.

“Consolidating debt can boost your credit score fast.”

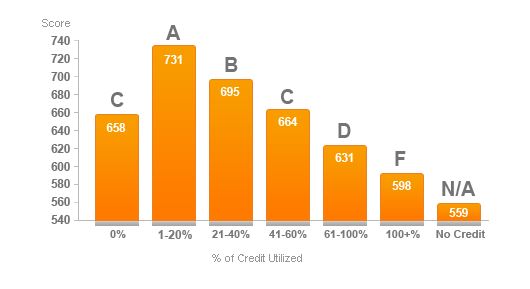

💡 3. Lower Your Credit Utilization Ratio (Stay Below 30%)

Here’s the kicker: Maxing out your credit limit is a red flag.

If you’re constantly using 70-90% of your credit limit, it makes you look credit-hungry, which hurts your score.

💡 Solution:

- Aim to keep your credit utilization below 30%.

- If your limit is ₹1,00,000 → Never spend more than ₹30,000 at a time.

Pro Tip: Ask your bank to increase your credit limit. It lowers your utilization ratio without you changing your spending habits.

✅ 4. Avoid Closing Old Credit Cards

You might think closing unused cards is smart, but it actually hurts your score.

Why? Because it shortens your credit history, which makes you look less reliable.

💡 Quick Fix:

- Keep old cards active—even if you rarely use them.

- Use them for small purchases and pay the bill in full to keep them alive.

The longer your credit history, the higher your score.

“Track your CIBIL improvements in real time with these tools.”

🔥 5. Diversify Your Credit Mix

Relying only on credit cards? Lenders prefer a healthy mix of secured and unsecured loans.

A diversified credit portfolio shows you can handle different types of debt responsibly.

💡 How to Fix It:

- If you only have credit cards, consider applying for a small personal loan.

- If you already have a loan, getting a credit card can improve your mix.

Why it works: A balanced mix boosts your creditworthiness.

🛑 6. Don’t Apply for Multiple Loans or Cards at Once

Applying for too many loans in a short period makes you look financially desperate.

Each application triggers a hard inquiry, which temporarily reduces your score.

💡 What to Do Instead:

- Space out your credit applications by 3-6 months.

- Check your eligibility before applying to avoid unnecessary rejections.

Pro Tip: Use a soft inquiry tool (offered by many banks) to check your creditworthiness without hurting your score.

💰 7. Settle Old Dues and Clear Defaults

Old defaults and unpaid loans haunt your credit report for years.

If you have any outstanding dues, clearing them can boost your score significantly.

💡 Solution:

- Negotiate a settlement or payment plan with your lender.

- Once you clear the dues, request the lender to update your status with CIBIL.

Pro Tip: Get a “No Dues Certificate” as proof of payment.

💡 8. Become an Authorized User on Someone Else’s Card

Here’s a smart hack:

If your friend or family member has a high-limit credit card with a stellar payment history, ask them to add you as an authorized user.

💡 Why It Works:

- You benefit from their credit history.

Your credit limit increases, lowering your utilization ratio.

📊 9. Use a Secured Credit Card to Rebuild Your Score

Struggling with poor credit?

Get a secured credit card by making a fixed deposit as collateral.

💡 Why It Works:

- It helps you build positive repayment history.

Even small purchases, if paid on time, improve your score.

✅ 10. Be Patient and Consistent

Here’s the truth:

There’s no overnight fix for a low CIBIL score.

The key is consistent, responsible financial behavior.

💡 Pro Tips:

- Always pay bills on time.

- Keep your credit utilization low.

Be patient—credit score improvement takes a few months.

“Use a loan calculator to understand how your score affects eligibility.”

✅ Key Takeaways: Improving Your CIBIL Score Fast

🔹 Check your report for errors regularly.

🔹 Pay bills on time—even the minimum due.

🔹 Lower your credit utilization to below 30%.

🔹 Keep old credit cards open.

🔹 Diversify your credit mix with loans and cards.

🔹 Avoid multiple applications simultaneously.

✅ Free Resource: Download Your CIBIL Score Checklist

Use our downloadable checklist to stay on top of your credit-building action plan.

👉 [Download the PDF Checklist]

🚀 Conclusion: Take Charge of Your Financial Future

Improving your CIBIL score is all about smart financial habits and consistency.

By following these proven tips, you’ll be well on your way to a higher score—and better financial opportunities.

👉 Take action today:

- Check your CIBIL report.

- Clear outstanding dues.

- Make every payment count.

💡 Your future self will thank you! 💰

🔗 Useful Links for Credibility:

- CIBIL Official Website – Check your credit score.

- Reserve Bank of India – Learn about credit score regulations.

- MoneyControl – Expert financial tips.

Usually, it takes 3 to 6 months to improve your CIBIL score if you follow consistent repayment and credit behavior.

Yes, paying your credit card bills early can lower your credit utilization and reflect positively on your CIBIL score.

A CIBIL score of 750 or above is generally considered a good score in India, making it easier to get loans and credit approvals.

No, checking your CIBIL score does not affect it, as long as it is a soft inquiry. Only hard inquiries, such as loan applications, can impact your score.

You can improve your CIBIL score quickly by paying off outstanding debts, reducing your credit utilization ratio, and ensuring timely payments.

Missed payments can negatively affect your CIBIL score as they signal poor credit behavior. The longer the delay, the more it impacts your score.

Yes, a personal loan, when repaid on time, can improve your CIBIL score as it demonstrates responsible borrowing and repayment.

Key factors include payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries.